If you’ve been thinking about starting a business in the United States but feel overwhelmed by the legal side of things, you’re not alone.

I’m Satyajit Srichandan, founder of BizFromZero. When I started learning about business formation, I felt exactly the way you might feel right now — confused about where to start, worried about making mistakes, and unsure if I could handle the paperwork myself.

Here’s what I learned: forming an LLC is much simpler than most people think. You don’t need a lawyer for most cases. You don’t need thousands of dollars. And you definitely don’t need to be a legal expert.

In this guide, I’ll walk you through every single step of how to form an LLC in the US, using simple language and real examples. By the end, you’ll have the confidence to register your own LLC — even if you’ve never done anything like this before.

This article is for educational purposes only and not legal or tax advice.

What Is an LLC? Definition, Benefits & How It Works

When I formed my first LLC, this protection gave me peace of mind. I knew that if something went wrong with my business, my personal savings were safe.

Let’s start with the basics.

LLC stands for Limited Liability Company. It’s a legal business structure that separates your personal assets from your business assets.

In plain English: if your business gets sued or goes into debt, your personal money, home, and car are generally protected. That’s the “limited liability” part.

Think of it this way — if you’re running a business as a sole proprietor (just you, no formal structure), and someone sues your business, they can come after your personal savings, your house, even your personal belongings. But with an LLC, there’s a legal wall between you and your business. The business is its own entity.

Here’s a real example:

Let’s say you run a freelance graphic design business. A client isn’t happy with your work and sues you for $50,000. If you’re operating as a sole proprietor, they could potentially go after your personal bank account. But if you’re operating as an LLC, they can only go after the business assets — not your personal money.

That’s why the LLC is one of the most popular business structures in the United States. According to the U.S. Small Business Administration, there are 36.2 million small businesses in the country as of 2026, and LLCs make up a significant portion of these entities.

Key benefits of an LLC:

- Personal asset protection — Your personal finances stay separate from business debts

- Tax flexibility — You can choose how you want to be taxed (we’ll touch on this later)

- Credibility — Having “LLC” after your business name makes you look more professional

- Simple structure — LLCs are easier to manage than corporations

Who Should Form an LLC?

An LLC isn’t for everyone, but it’s a great fit for many types of business owners.

You should consider forming an LLC if you are:

- A freelancer or consultant who works with clients and wants legal protection

- An online business owner selling products or services

- A side hustler turning a hobby into a business

- A non-US resident starting a US-based business (yes, non-residents can form US LLCs)

- Anyone taking on business risk — if there’s any chance of getting sued or going into debt, an LLC makes sense

From what I’ve learned, if your business involves working with clients, selling products, or any activity where you could be held liable for something going wrong, an LLC is worth considering.

You don’t need to be making millions. Even if you’re just getting started and earning a few hundred dollars a month, forming an LLC can protect you as you grow.

What You Need Before You Form an LLC

Before you start the LLC formation process, gather these items:

1. A business name

You’ll need a unique name for your LLC. It must be different from other businesses registered in your state, and it must include “LLC” or “Limited Liability Company” at the end.

2. A state to register in

Most people register in the state where they live and operate. However, some choose states like Delaware or Wyoming for specific reasons (we’ll cover this below).

3. A registered agent

This is a person or service that receives legal documents on behalf of your LLC. It’s required by law in almost every state.

4. A business address

You’ll need a physical address (not a P.O. box) where your business operates or where your registered agent is located.

5. Basic owner details

You’ll provide your name, address, and sometimes your Social Security Number or tax ID.

That’s it. You don’t need a business plan, a logo, or even a website to form an LLC. Those things can come later.

How to Form an LLC: 7-Step Process (2026)

Now let’s get into the actual steps. This is the core of how to start an LLC.

Step 1 – Choose Your State

The first question most people ask is: “Which state should I form my LLC in?”

Here’s the simple rule: If you’re a beginner operating a small business, register in the state where you live or where you do most of your business.

Why? Because if you register in a different state (like Delaware or Wyoming), you’ll likely need to register as a “foreign LLC” in your home state anyway — which means more paperwork and more fees.

When it makes sense to register out of state:

- You’re running an online business with no physical location

- You want specific privacy protections (Wyoming offers strong privacy)

- You’re raising venture capital (Delaware is popular with investors)

But for 90% of beginners, your home state is the best choice.

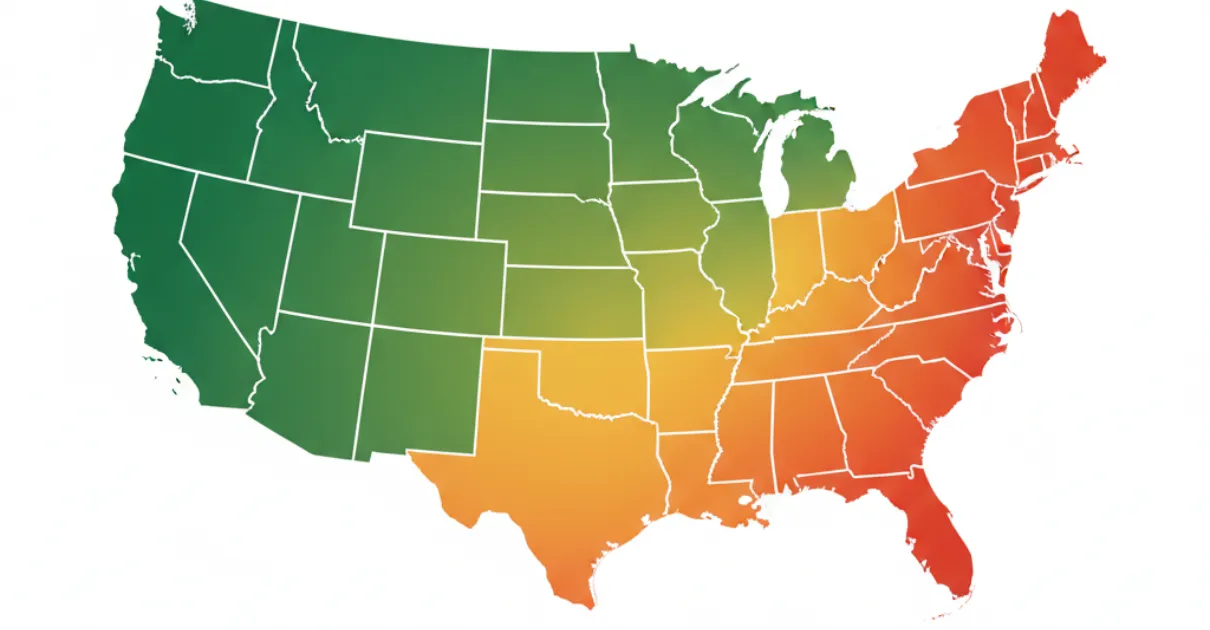

According to data from the SBA, between March 2023 and March 2024, small businesses opened 1.1 million new establishments across the United States. The top three states for small business count are California (4.34 million), Texas (3.52 million), and Florida (3.49 million).

Step 2 – Choose a Business Name

Your LLC name must be unique in your state and must include “LLC” or “Limited Liability Company.”

How to check if your name is available:

- Go to your state’s Secretary of State website

- Look for the business name search tool

- Enter your desired name

- If it’s taken, try variations

Naming rules to follow:

- Can’t be too similar to existing businesses

- Must include “LLC,” “L.L.C.,” “Limited Liability Company,” or an approved abbreviation

- Can’t include restricted words like “Bank” or “Insurance” without special approval

If you’re not ready to file but want to secure a name, many states let you reserve it for a small fee (usually $10-$50) for a limited time.

Step 3 – Appoint a Registered Agent

A registered agent is a person or service that receives legal documents on behalf of your LLC.

Here’s what they do:

- Receive legal papers if your business gets sued

- Accept official mail from the state (like annual report reminders)

- Forward important documents to you

Requirements for a registered agent:

- Must have a physical street address in your state (no P.O. boxes)

- Must be available during normal business hours (9 AM – 5 PM)

- Must be at least 18 years old

Your options:

- Be your own registered agent (free, but your name and address become public)

- Appoint a trusted friend or family member (must meet requirements)

- Hire a registered agent service (costs $100-$300 per year, provides privacy)

Most beginners choose to be their own registered agent to save money. Just know that your home address will be public record if you go this route.

Step 4 – File Articles of Organization

This is the main document that officially creates your LLC.

What it includes:

- Your LLC name

- Your registered agent’s name and address

- Your business address

- Names of LLC members (owners)

- Purpose of your business (you can keep this general)

Where to file:

Go to your state’s Secretary of State website. Most states let you file online.

Filing fees by state (2026 data):

State filing fees vary widely. According to current research:

- Lowest fees: Kentucky ($40), Arkansas ($45), Montana ($35)

- Mid-range fees: Florida ($125), Texas ($300), Colorado ($50)

- Highest fees: Massachusetts ($500-$520), California ($70 state fee plus annual $800 franchise tax)

The average LLC filing fee across all states is around $130-$132.

How long it takes:

Processing times vary by state:

- Online filing: Most states process in 1-10 business days

- Mail filing: 2-6 weeks on average

- Expedited filing: Some states offer same-day or 24-hour processing for an extra fee ($25-$150)

Fastest states: Delaware, Florida, Nevada, Wyoming (often 1-2 days)

Slowest states: California, New York, Arizona (can take 3-7 weeks by mail)

The average processing time across all states is about 4 days for online filings.

Step 5 – Get an EIN from the IRS

An EIN (Employer Identification Number) is like a Social Security Number for your business.

You need it to:

- Open a business bank account

- Hire employees

- File business taxes

- Apply for business licenses

How to get it:

- Go to the IRS website (irs.gov)

- Search for “Apply for EIN”

- Fill out the online form (takes about 10 minutes)

- Get your EIN immediately (it’s free)

You must have your LLC officially formed before you can apply for an EIN. The IRS won’t issue one for a business that doesn’t legally exist yet.

Step 6 – Create an Operating Agreement

An operating agreement is a document that explains how your LLC will be run.

What it includes:

- Who owns what percentage of the business

- How profits and losses are distributed

- Roles and responsibilities of members

- How decisions are made

- What happens if someone wants to leave

Do you legally need one?

Most states don’t require it, but California, Delaware, Missouri, and New York do. Even if your state doesn’t require it, you should still create one.

Why? Because it protects you if there’s ever a dispute between LLC members, and it strengthens your limited liability protection.

You can find free operating agreement templates online or hire a lawyer to draft one (costs $200-$500).

Step 7 – Open a Business Bank Account

Once you have your LLC documents and EIN, open a separate bank account for your business. (Best Bank for LLCs)

Why this matters:

- Keeps business and personal money separate

- Makes accounting and taxes easier

- Protects your limited liability status

If you mix personal and business money, you could lose your LLC’s legal protections. This is called “piercing the corporate veil.”

What you need to open an account:

- EIN

- Articles of Organization

- Operating Agreement (sometimes)

- Personal ID

Cost to Form an LLC

Let’s talk about money.

Here’s what you’ll actually pay:

1. State filing fee: $35-$500 (average $130-$132)

2. Registered agent: $0 (if you do it yourself) or $100-$300/year (if you hire a service)

3. Operating agreement: $0 (if you use a template) or $200-$500 (if you hire a lawyer)

4. EIN: $0 (it’s free from the IRS)

5. Business bank account: Usually free to open, but check for monthly fees

Total first-year cost:

If you do everything yourself: $35-$500 (just the state fee)

If you hire services: $300-$1,000

Annual costs:

Most states require an annual report and fee to keep your LLC active.

- No annual fee: Arizona, Missouri, New Mexico, Ohio

- Low annual fees: Many states charge $25-$100

- Higher annual fees: California ($800 franchise tax), Delaware ($300)

Remember: these are ongoing costs you’ll pay every year to keep your LLC in good standing.

How Long Does It Take to Form an LLC?

Timeline breakdown:

- Choosing a name and gathering info: 1-3 days

- Filing Articles of Organization: Instant to 6 weeks (depending on state and method)

- Getting your EIN: Same day (online application)

- Opening a bank account: 1-3 days

Total time: 1-8 weeks depending on your state and how you file.

If you file online in a fast state like Florida or Delaware, you could have your LLC approved in 1-3 days. If you file by mail in California, it could take 3-7 weeks.

Most states process online filings in about 3-10 business days on average.

Can You Form an LLC by Yourself?

Yes. Absolutely.

You do not need a lawyer to form an LLC. The process is designed to be simple enough for anyone to complete.

When you might want professional help:

- You’re forming a multi-member LLC with complex ownership

- You’re in a highly regulated industry (healthcare, finance, etc.)

- You have specific tax questions

- You want someone to handle everything for you

When you DON’T need a lawyer:

- You’re a solo business owner

- You’re forming a simple one-member LLC

- You’re comfortable filling out forms online

The process is designed to be straightforward enough for most people to complete on their own. I’ve learned that many successful business owners handle their own LLC formation without any issues.

Best Way to Form an LLC Online

You have three main options:

1. Do it yourself (DIY)

Pros:

- Cheapest option (only pay state fees)

- Full control over the process

- Good learning experience

Cons:

- Takes more time

- You’re responsible for accuracy

- You handle all follow-up yourself

Best for: Budget-conscious founders who want to learn the process

2. Use an online LLC formation service

Popular services include Northwest Registered Agent ($39 + state fee), LegalZoom ($149 + state fee), ZenBusiness, and Incfile.

Pros:

- Fast and convenient

- They check your work

- Often includes registered agent service for the first year

- Some provide compliance reminders

Cons:

- More expensive than DIY

- May try to upsell additional services

- You still need to understand the basics

Best for: Busy founders who want help but don’t need a lawyer

3. Hire a lawyer

Pros:

- Expert guidance

- Customized advice for your situation

- Help with complex issues

Cons:

- Most expensive ($500-$2,500)

- Often overkill for simple LLCs

Best for: Complex business structures or highly regulated industries

My recommendation: If you’re forming a basic, single-member LLC, do it yourself. If you’re willing to spend $150-$250 for convenience, use an online service. Only hire a lawyer if you have complicated needs.

State-Specific LLC Formation (Quick Guide)

Different states have different quirks. Here’s a quick overview of some popular states:

California LLC

- Filing fee: $70

- Annual fee: $800 franchise tax (yes, even if you make $0)

- Processing time: 5-10 days online, 3-7 weeks by mail

- Special note: High annual costs make California one of the more expensive states

Texas LLC

- Filing fee: $300

- Annual fee: None (but you must file an annual report)

- Processing time: 2-3 days online

- Special note: Higher upfront fee but no ongoing franchise tax

Florida LLC

- Filing fee: $125

- Annual fee: $138.75

- Processing time: 2-5 days online

- Special note: Popular for online businesses; fast processing

New York LLC

- Filing fee: $200

- Annual fee: $9 biennial fee

- Processing time: 3-7 days online

- Special note: Requires publication in local newspapers (can cost $500-$1,200 extra)

Arizona LLC

- Filing fee: $50

- Annual fee: $0

- Processing time: 20-27 days

- Special note: Also requires newspaper publication

For the most current information, always check your state’s Secretary of State website directly.

7 Common Beginner Mistakes

I’ll be honest—I made mistake #2 (mixing finances) in my first month. It took me weeks to sort it out. Learn from my errors:

These are common mistakes I’ve learned about through research and forums. Avoid them:

1. Choosing the wrong state

Don’t register in Delaware just because you heard it’s “better.” Unless you have a specific reason, stick with your home state.

2. Mixing personal and business finances

Once you form your LLC, open that separate bank account immediately and use it for everything business-related.

3. Skipping the operating agreement

Even if your state doesn’t require it, create one. It protects you legally and prevents future disputes.

4. Forgetting to get an EIN

You need this to open a bank account and handle taxes properly. Get it right after your LLC is approved.

5. Not checking name availability thoroughly

Just because a name is available doesn’t mean someone isn’t using a similar one. Search carefully to avoid trademark issues.

6. Ignoring annual requirements

Most states require you to file an annual report and pay a fee. Missing this can get your LLC dissolved.

7. Thinking an LLC solves all tax problems

An LLC doesn’t automatically reduce your taxes. Talk to an accountant about the best tax structure for your situation.

Action Checklist

Here’s your step-by-step checklist to form an LLC:

- Choose your state (usually where you live)

- Pick a unique business name (check availability on state website)

- Decide on a registered agent (yourself or a service)

- Gather required information (name, address, member details)

- File Articles of Organization with your state

- Pay the state filing fee ($35-$500 depending on state)

- Wait for approval (1-10 days online, longer by mail)

- Apply for an EIN from the IRS (free, online, immediate)

- Create an operating agreement (use a template or hire help)

- Open a business bank account (bring LLC docs and EIN)

- Apply for necessary business licenses (if required for your industry)

- Set up accounting system (can be as simple as a spreadsheet)

- Mark calendar for annual filing requirements

Frequently Asked Questions

How to form an LLC step by step?

- Choose your state and business name

- Appoint a registered agent

- File Articles of Organization with your state

- Pay the filing fee ($35-$500)

- Get an EIN from the IRS

- Create an operating agreement

- Open a business bank account

The entire process takes 1-8 weeks depending on your state.

What documents are required to start an LLC?

The main document is the Articles of Organization (also called Certificate of Formation in some states). You’ll also need:

- A registered agent designation

- An operating agreement (recommended even if not required)

- An EIN from the IRS

- Personal identification to open a bank account

How much does it cost to start an LLC?

Bare minimum: $35-$500 (just the state filing fee)

Realistic budget: $150-$500 if you do everything yourself

With services: $300-$1,000 if you use formation services and registered agent help

Annual costs vary by state but typically range from $0-$800 per year.

Can I form an LLC by myself?

Yes. You don’t need a lawyer or formation service to create an LLC. The process is straightforward and can be completed entirely online in most states.

You only need professional help if:

- You have multiple members with complex ownership structures

- You’re in a heavily regulated industry

- You want someone else to handle the paperwork for you

Do I need a lawyer to form an LLC?

No. Most small business owners successfully form LLCs without legal help.

Consider hiring a lawyer only if:

- Your business structure is complex

- You need specific legal or tax advice

- You’re raising investment capital

- You’re in a regulated industry like healthcare or finance

For a basic single-member LLC, doing it yourself or using an online service is perfectly fine.

How to register an LLC online?

- Go to your state’s Secretary of State website

- Find the business filing or LLC formation section

- Fill out the online Articles of Organization form

- Provide your business name, registered agent, and member information

- Pay the filing fee with a credit or debit card

- Submit the form

- Wait for approval (usually 1-10 days)

Most states now offer online filing, which is faster and easier than mailing paper forms.

Conclusion

Forming an LLC doesn’t have to be complicated or expensive.

If you follow the steps in this guide, you can create your LLC yourself in less than a week — without a lawyer and without spending thousands of dollars.

Here’s what you need to remember:

- An LLC protects your personal assets from business debts and lawsuits

- You can form one yourself in most states for $35-$500

- The process takes 1-8 weeks depending on your state and filing method

- You don’t need a lawyer for simple, single-member LLCs

- Always keep business and personal finances separate

Your next steps:

- Decide which state you’ll form your LLC in

- Check name availability on your state’s website

- Gather the information you’ll need (registered agent, business address, etc.)

- Set aside 1-2 hours to complete the online filing

- Mark your calendar for annual report deadlines

At BizFromZero, we believe that anyone can build a real business from absolute zero — and forming an LLC is one of the most important first steps you can take.

You’ve got this.